The emergence of “other” Bordeaux

We know well the performance of Bordeaux Premiers Grands Crus on the secondary market, but, according to Liv-ex, if we look beyond the big names, we notice that the other wines of the region have nothing to be ashamed of.

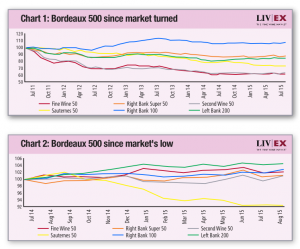

Since the peak of the market in 2011, prices for Premiers Grands Crus have fallen by 39 %.

There was a slight recovery last year with a rise of 0.94 TP3T in the Fine Wine 50 index, but it is undeniable that the most important indices are down. But can we consider that the Premiers Grands Crus represent the entire Bordeaux market? We looked at the performance of the Liv-ex Bordeaux 500 sub-indexes to see how other wines fared.

As shown in Chart 1, the Right Bank 100 has been the best index since the start of the market decline; it increased by 7.6 % over this period. The ten wines in this index form two very distinct groups: five of them experienced an increase, while the other five faced a decline. The best progression is that of Angélus, +35.5 % since July 2011. Its promotion to the rank of Premier Grand Cru Classé A during the re-classification of Saint-Émilion wines in September 2012 strongly contributed to its meteoric rise. . Pavie, the other promoted wine, increased by 17.3 %. With an increase of 33.8 %, Clos Fourtet has the second best performance, in particular thanks to the score of 100 points attributed to its 2009 vintage and thanks to its description by Robert Parker: "one of the best young Bordeaux wines [that he has ] tasted. »

Over this period, the Bordeaux 500 fell by 20.2 % and as shown in Chart 1, the Right Bank 100 is the only index up. If it had fallen like the Left Bank 200 (and, perhaps, Angelus and Pavie hadn't been promoted), the Bordeaux 500 would have seen a drop of 23.1 %.

However, the positive impact of the promotion faded. Following thirteen consecutive monthly increases in 2012-2013, the progression of the Right Bank 100 stagnated and the index was overtaken by the Second, Third, Fourth and Fifth Growths from the other bank of the Gironde.

The Left Bank 200 may have fallen 15.7 % since July 2011, but as Chart 2 shows, it has risen 4.5 % since the market low in July 2014 while the Right Bank 100 n 'rose only 2.8 %. One of the Left Bank 200 wines has stood out over the past thirteen months: Haut-Bailly, whose 2009 vintage was re-evaluated at 100 points by Parker following a vertical tasting in November 2014. This new rating was made official in April 2015. Mission Haut-Brion, whose prices in July 2014 had returned to 2007 levels, has seen an increase of 9.2 % since then. Its sales were strongly influenced by the score of 97 points attributed to its 2012 vintage (one of the best scores given by Parker during its bottle tastings in April) and by that of 100 points that its 2005 vintage received in June.

Even if the last few years have not been easy for the Bordelais, the figures indicate the beginnings of recovery. The bull market from 2009 to 2011 was driven by brand name recognition. As buyers now seem more driven by quality, it looks like the fundamentals of wine investing are being turned around.

October 7, 2015

by the team of The Drinks Business