Liv-ex: the price of Burgundy rarity

The prices of the great Burgundies are starting to outpace those of the Bordeaux Premiers Grands Crus. While the region continues to bet on its rarity, it is not surprising to question the value of its wines compared to those of Bordeaux.

At the start of 2016, Bordeaux wines are once again looking gloomy.

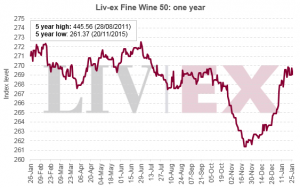

For the Bordeaux region, 2015 was a more stable year than the previous four: the Liv-ex Fine Wine 50 index fell by only 0.7 % and the Bordeaux 500 ended the year down 0, 2 % only.

A very different scenario from that of another major French wine region, Burgundy.

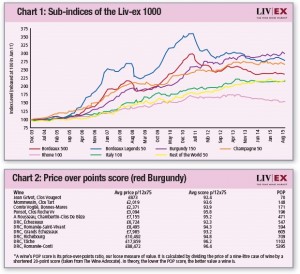

The Burgundy 150 Index (a sub-index of the Liv-ex 1000) reached a new high in 2015. It ended the year up 1.3 % and was among the top Liv-ex indexes. It brings together six Domaine de la Romanée-Conti and ten other wines (five whites and five reds) and generally corresponds to the Burgundy Premiers Crus.

As shown in Chart 1, since December 2003, prices have risen by 200 % to flirt with those of Bordeaux when it was at its peak and approach a new high. But is there a risk that these prices will experience the same fate as those of Bordeaux?

The table displays prices for most red wines in the Burgundy 150 index which now equal or exceed those of the Bordeaux Premiers Grands Crus.

The average price of a case of Haut-Brion is £3,333 (€4,363, for the 2003-2012 vintages), and its average score is 96.4 (like Domaine de la Romanée-Conti), but for a POP score (price/point ratio) of barely 203.

Even Lafite Rothschild, with an average POP score of 313, offers better relative value than seven of the Burgundies in question.

Compared to other regions, Burgundy prices seem even more unbalanced; the average price for a case of Italian “Super-Tuscan” is £1,725 (€2,259), and only £1,396 (€1,828) for champagne. The great Burgundies (and especially DRC) still exploit their exclusive character.

DRC only produced 5,673 bottles in 2011, and even La Tâche (the largest volume) only produced 18,196 bottles that year, or 1,516 cases of 12 x 75cl bottles.

In comparison, Lafite Rothschild produces an average of 16,000 cases per year. The ratings given to Burgundy by The Wine Advocate are generally lower than those of Bordeaux. The last score of 100 points for Domaine de la Romanée-Conti dates from its 1985 vintage. Nevertheless, as long as demand exceeds supply, we will continue to snap up the big Burgundian brands.

When Bordeaux lost popularity in 2011, Burgundy quite naturally inherited the interest of buyers. Since 2006, it has been the second region of Liv-ex in terms of exchanges. She contributed to a peak of 7 % in this field in 2013.

Yet, while some traders may speak of steady demand, market interest is waning. In 2015, Burgundy's market share fell by 6 % to the benefit of Italy (7.1 %) and Champagne (6.5 %). For several years now, the ascent of Burgundy does not seem to be able to last.

Now that the prices of Bordeaux Premiers Grands Crus have fallen by 40 TP3T from their peaks and continue to fall, the gap in value between the two regions is widening.

When buyers can acquire three cases of Haut-Brion for the price of one case of DRC Richebourg, is it justified to pay so much for rarity?

27th January, 2016 by Neal Baker